HSBC Amanah Term Deposit-i

It's easy to open an account online.

Key Benefits and Privileges

- Higher returns than an ordinary savings accountEnjoy fixed and competitive deposit rates from 1.95% - 2.15% p.a.

- Flexible deposit amounts and tenuresMake flexible placement from as low as RM1,000 (2 months and above) or RM5,000 for 1 month

- Easy to openOnline account opening in a few simple steps. It's a paperless application - simple and convenient

Profit Rate

| Tenure (month) |

Profit rate (% p.a.) |

|---|---|

| 1 | 1.95% |

| 2 | 2.00% |

| 3-5 | 2.05% |

| 6-12 | 2.10% |

| 13-60 | 2.15% |

| Tenure (month) |

1 |

|---|---|

| Profit rate (% p.a.) |

1.95% |

| Tenure (month) |

2 |

| Profit rate (% p.a.) |

2.00% |

| Tenure (month) |

3-5 |

| Profit rate (% p.a.) |

2.05% |

| Tenure (month) |

6-12 |

| Profit rate (% p.a.) |

2.10% |

| Tenure (month) |

13-60 |

| Profit rate (% p.a.) |

2.15% |

Minimum deposit of RM5,000 for one (1) month tenure or RM1,000 for tenure of two (2) months and above.

If you withdraw the term deposit-i before the maturity date, you shall provide us with a rebate (ibra’) on the profit portion payable from the Murabahah Sale Price:

For term deposit-i placed/renewed before 1 March 2025:

- If the term deposit-i is held for less than 3 months, you won't receive a profit, and you shall provide us with a full rebate (ibra') on the actual profit portion contracted

- If the term deposit-i is held for 3 months or longer, we will pay the profit at half of the contracted rate for each completed month, and you shall provide us with a rebate (ibra') equivalent to the sum of half of the profit for the completed months and the full profit for the uncompleted months

For term deposit-i placed/renewed on or after 1 March 2025:

You shall provide us with a full rebate (ibra') on the profit portion payable if you withdraw the term deposit-i before the maturity date, and you won't receive a profit.

The rebate shall be deducted from the Murabahah Sale Price.

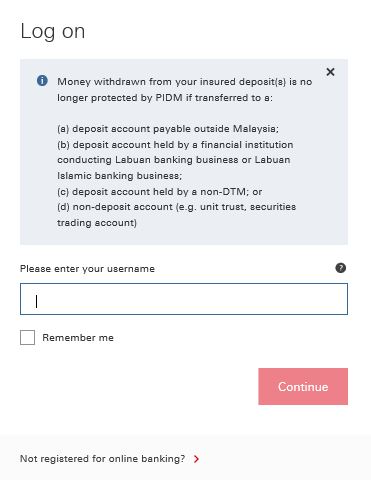

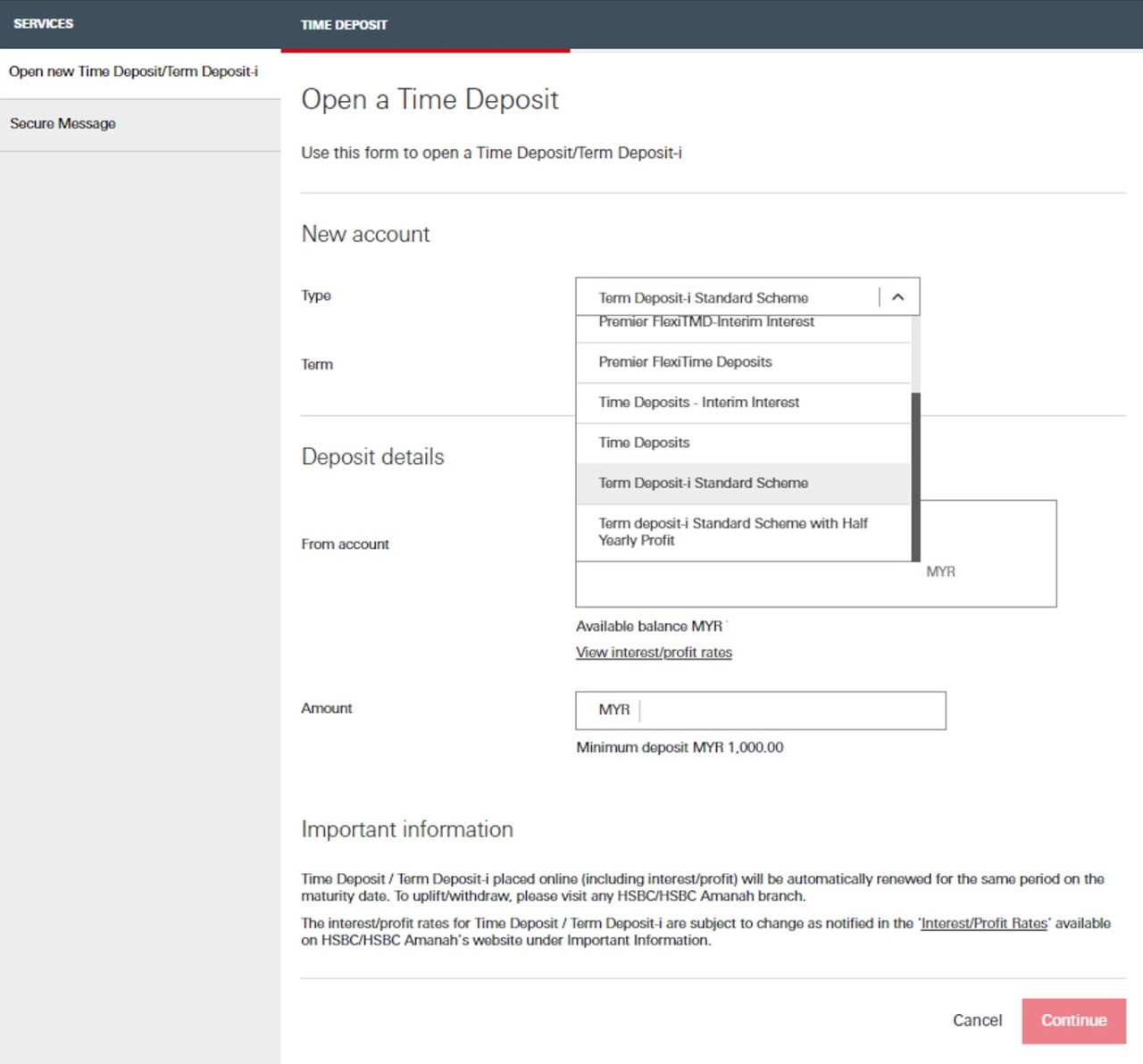

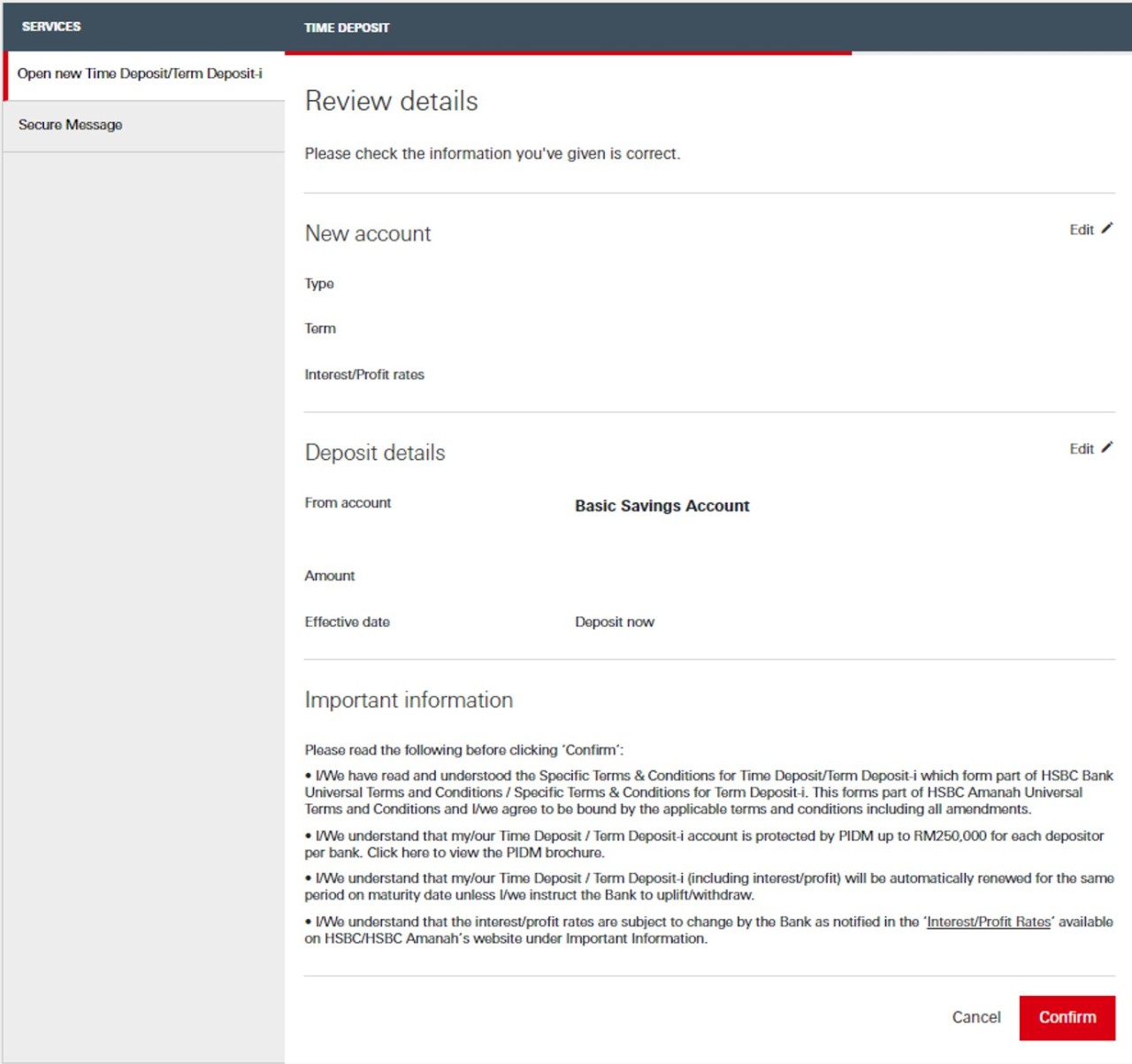

How to place Term Deposit-i online in 3 simple steps

Apply for Term Deposit-i in a few simple steps

Existing HSBC customer

New to HSBC

Prerequisite of opening term deposit-i is to have at least one HSBC Amanah savings or current account-i for fund channeling purposes.

Things you should know

To be eligible for Term Deposit-i, you must:

- Have at least one HSBC Amanah current account-i or savings account-i

- Minimum deposit amount: RM5,000 for 1 month or RM1,000 for 2 months and above

Member of Perbadanan Insurans Deposit Malaysia

Protected by Perbadanan Insurans Deposit Malaysia up to RM250,000 for each depositor*.

Frequently asked questions

Related products

Save, spend and transact in 11 currencies with 1 Account

Open an Everyday Global Account-i today.

T&Cs apply.

Basic Savings / Current Account-i

Enjoy convenience and control every minute of the day.